Enterprise data model for buy-side firms, tailored for the needs of Wealth and Asset Managers. The model covers key entity domains such as Business Relationship, Investment Strategy, Asset Classification and Investment Propositions.

Purpose

Buy-side firms are under enormous pressure to keep up with the digital transformation wave. Changing client demands, regulatory pressure and the rapid adoption of online, self-service investment management approaches are fueling investment into digital platforms and data driven Wealth & Asset Management. Often, firms are held back by legacy infrastructure and a fragmented data landscape. Traditional data warehousing approaches are not well suited to modern digital and analytical solutions exposed to the end client; they struggle to adhere to the stringent regulatory requirements inherent in data privacy, cross border access and internal data governance.

EPAM’s GLUE Data Model has been designed for strong security, client data protection and GDPR compliance with clear separation of sensitive data, late enrichment and anonymized analytical patterns. It provides the flexibility to model hierarchical organization structures and instrument classification schemes, as well as the complex legal entity structures of typical buy-side client relationships.

This forms the basis of modern, data driven hybrid advisory platforms for clients and advisors, specifically targeting next generation digital experiences. The GLUE Model, along with an appropriate platform implementation, will support necessary fault tolerance, disaster recovery and continuity.

Features of GLUE

- High-Performance in-memory analytical data fabric powering digital advisor and client solutions

- Enabling massive parallelization of analytical calculations in a distributed in memory store

- Enterprise grade fault tolerance and disaster recovery, horizontal scalability

- Cloud native architecture deployable in public and private clouds

- High degree of data security, GDPR compliant

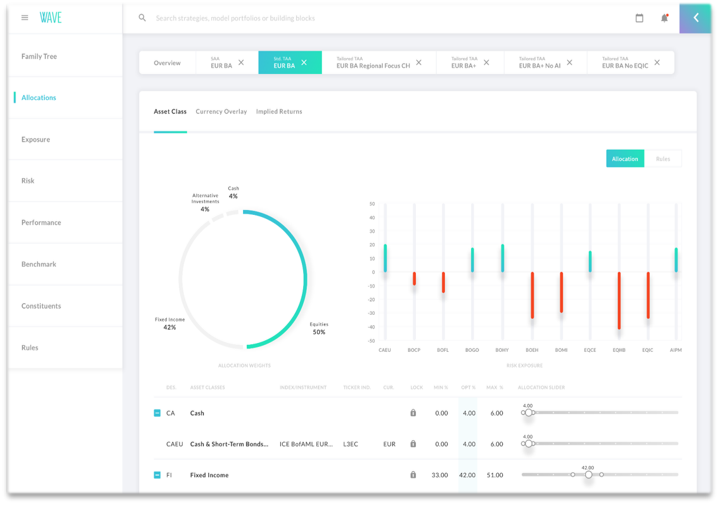

Investment Management

A tool for the Chief Investment Office to manage strategies and model portfolios for discretionary and advisory mandates Based on vast series of market and economic risk factors (expected returns, regional biases, volatility, correlations, etc.) construct dependent strategies and portfolios under consideration of regional or client-specific requirements.

- Set-up and maintain strategies and model portfolios

- Manage your investment universe and benchmarks

- Set-up and adjust house views with different methods

- Manage rules- or risk-based derivation

- Run risk analytics on market & economic risk factors

- Create historical & forward-looking stress test scenarios

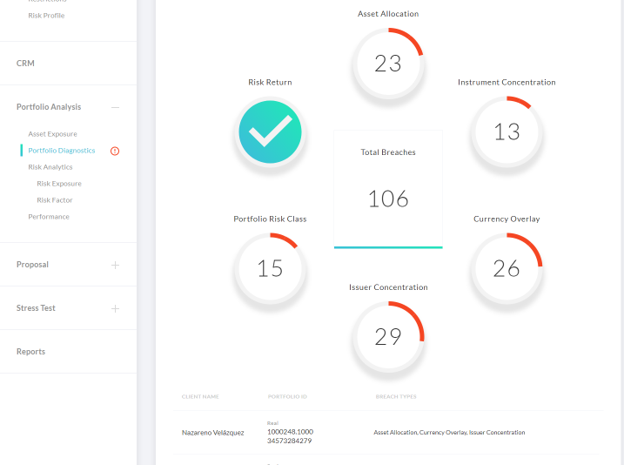

Portfolio Health Monitoring Tool

A tool that alerts bank managers, client advisors and clients alike about deviations between the current client portfolio and agreed investment instructions. The flexible framework let you set up new types of restrictions easily and customize it for the bank.

- Tailored investment strategies can be build based on customizable restriction sets and capital market assumptions e.g: asset allocation, currency overlay, issuer concentration, product risk class, etc.

- The tool assesses the violations in the current client portfolio in comparison to the agreed investment strategy and specific client instructions

- The Wealth Manager/Client Advisor can easily prepare an investment proposition so that the violations can be resolved

- The tool can also be used to evaluate the investment proposition by creating simulated portfolio and comparing its attributes with the client investment strategy

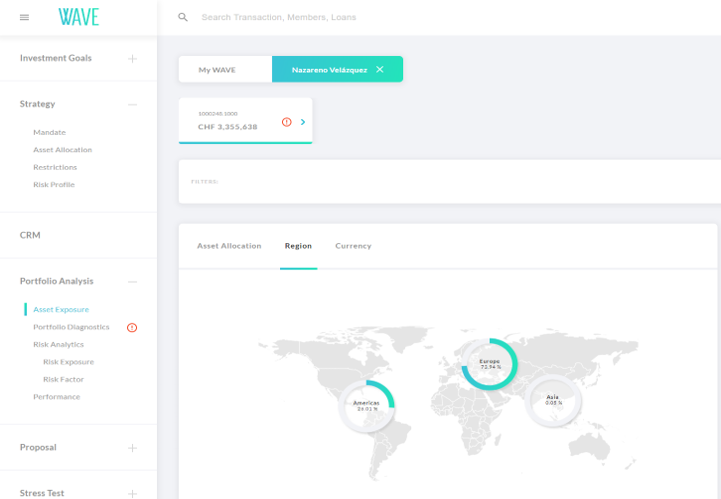

Asset Exposure Reporting Tool

Wealth Managers and Client Advisors can explore the aggregated portfolio holdings along multiple dimensions (e.g. asset class, currency, region, product type).

- Authorization level hierarchical views can be built to display an entire booking centre to single client portfolios

- Based on the flexible table structures in GLUE specific views can be built and multiple combinations of filters from different dimensions are supported, e.g: region, asset class, investment strategy, currency, responsible client advisor, etc.